Real Estate Report: Where is the Market Headed?

July 8th, 2019

There are two subjects that always bring out strong opinions in discussions and most people portray themselves as experts in both; Food & Real Estate. I too often voice my opinion on these two subjects, but real estate is normally the one where my opinion is solicited. If you’ve opened any digital or print media or turned on a news program real estate performance is often tracked like a daily stock. It is crazy. Some report prices going up while others are “preparing us for the bubble”. What does it all mean? If you’ve noticed, real estate reporting is rarely done at the local news level. The national networks or national publications roll out standardized talking points regarding how the national market is doing. Well, the national market is determined by the sum total of all the little local markets rolled up to an Up or Down reporting figure. If you’re interested in tracking the value of your property here does it really matter to you how properties are selling in California? The right answer is…maybe? Here in the southeast and specifically the Grand Strand, we are tied to the performance of other markets. We’ve discussed Leader and Feeder markets in previous articles, but each area that we follow or feed on can impact the values here. These are longer, sweeping changes that can alter pricing over many months or years, but it is still good to watch the trends from other areas to see how it filters to your property. The more important real estate tracking is done locally and in most cases, it isn’t newsworthy. You can usually pick up the information from your neighbors, friends or a local Realtor you have a relationship with, or even try pulling it from Zillow every so often. There are many different services you can sign up for free that update you too if you really want to stay in the know.

WHAT DOES IT ALL MEAN?

So, how are homes on Sandlapper Way selling? How many homes are available on Bellasara Circle right now? How are high-end homes selling compared to last year? Is it a Seller’s market? Comparison valuation is a process that can be used for neighborhoods, single properties or even years. You can compare one street sales to another street or the same street from one year to the next. Same goes for properties or neighborhoods. So, how is Grande Dunes doing and what is the story for the overall market?

SINGLE-FAMILY HOMES

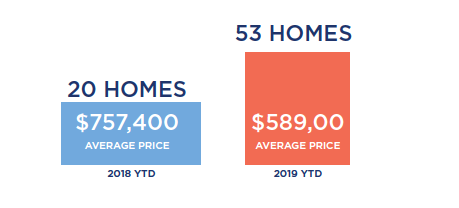

The year-to-date figures are remarkably similar to last year so far for Grande Dunes and the Grand Strand. While the average price of a single-family home has increased 9% YOY there have been a total of 3 fewer homes close so far. 2,877 last year and 2,874 this year. In Grande Dunes the numbers are reversed with far more homes closed, but with the average sales price being lower. Last year 20 homes closed at an average price of $757,400 while this year 53 homes have closed that average out at $589,000.

CONDOS

Condo sales for the Grand Strand are pretty flat in pricing with 3% more properties closing YOY. Grande Dunes has had twice the number of condos close so far as the same period last year with pricing hovering around $275,000 average.

HOMESITES

Lot sales along the Grand Strand and Grande Dunes are softer than last year with prices either flat (Grand Strand) or down slightly (Grande Dunes). The average sales price along the Grande Strand is $125,000 and in Grande Dunes $219,900. In Grande Dunes the numbers are reversed with far more homes closed, but with the average sales price being lower. Last year 20 homes have closed at $757,400 while this year 53 homes have closed that average $589,000. Overall, when looking at the three residential segments; SFH, Condo & Lots, our market is basically performing as it did last year. We are not quite halfway through the year yet and historically the best is ahead of us in 2019. The buyers looking for properties here are mostly primary residence or second home buyers. Many people are relocating here and that demand is driving the market in a healthy way, as opposed to investment buyers or buyers with little invested in the purchase. I expect the year to continue going well with approximately 40% of homes sold being new builds and 60% being existing homes, like yours.

Overall, when looking at the three residential segments; SFH, Condo & Lots, our market is basically performing as it did last year. We are not quite halfway through the year yet and historically the best is ahead of us in 2019. The buyers looking for properties here are mostly primary residence or second home buyers. Many people are relocating here and that demand is driving the market in a healthy way, as opposed to investment buyers or buyers with little invested in the purchase. I expect the year to continue going well with approximately 40% of homes sold being new builds and 60% being existing homes, like yours.